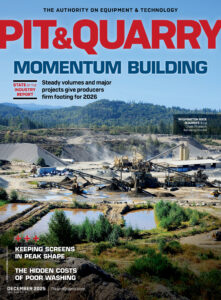

Vulcan Materials Co. reported a series of gains throughout its aggregate segment in the third quarter.

Gross profit in the segment was up 23 percent to $612 million, and gross profit margin increased 250 basis points to 34.2 percent.

Aggregate cash gross profit per ton increased 9 percent in the third quarter to $11.84 per ton. According to Vulcan, this marked the 11th consecutive quarter of double-digit compounding improvement in unit profitability.

Aggregate shipments also increased in the third quarter, growing 12 percent compared to the third quarter of 2024. Vulcan shipped 64.7 million tons of aggregates in the third quarter this year. The company attributes this success, in part, to more favorable weather in most markets. Throughout last year’s third quarter, Vulcan says shipments were disrupted by hurricanes and severe storms across the Southeast.

Freight-adjusted selling prices, meanwhile, increased 5 percent in the quarter ($22.01 per ton). Vulcan reports that freight-adjusted unit cash cost of sales, however, decreased 2 percent to $10.17 per ton. The company says the decrease is reflective, in part, of its continued operating cost discipline and the benefit of strong shipments in the quarter.

“The combination of our aggregates-led business and our commercial and operational execution has resulted in strong earnings growth and margin expansion through the first nine months of 2025,” says Tom Hill, Vulcan chairman and CEO. “Adjusted EBITDA has improved 20 percent over the prior year, and margin has expanded 290 basis points on a year-to-date basis. Aggregates cash gross profit per ton has improved 12 percent with widespread improvements across our footprint.”

Hill is optimistic about the rest of this year and has high hopes for 2026, as well.

“We continue to execute well and remain focused on delivering another year of margin expansion and attractive growth in aggregates unit profitability,” Hill says. “Aggregates shipments through the third quarter have increased 3 percent, and we expect full-year shipments to reflect similar year-over-year growth. As a result, we expect to deliver between $2.35 and $2.45 billion of adjusted EBITDA in 2025, representing 17 percent year-over-year growth at the midpoint.

“As we look to 2026, I’m encouraged about the demand backdrop in our markets,” Hill adds. “We expect continued strength in public construction activity and an improving private nonresidential outlook, a combination that should also benefit an already healthy pricing environment.”

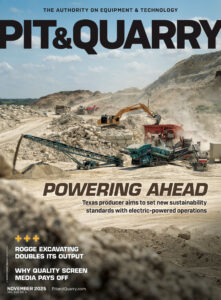

Changing of the guard

Earlier this year, it was announced that Ronnie Pruitt, Vulcan Materials’ COO, will take over as CEO at the start of 2026. Hill, who was enshrined in the Pit & Quarry Hall of Fame this year, will transition to the role of executive chairman of the board.

“I’m excited about our talented teams that will continue to execute on our proven two-pronged, durable growth strategy under Ronnie’s leadership,” Hill says. “Ronnie is the ideal person to lead Vulcan’s future growth and innovation.”

Pruitt feels Vulcan is set up for continued success moving forward.

“Vulcan is well positioned with an irreplaceable asset base and outstanding talent,” Pruitt says. “Our strategic disciplines on both the commercial and operational sides of our business continue to gain traction and sustain improvements. These competitive advantages, coupled with modest growth in shipments and mid-single digit growth in pricing, will help drive another year of earnings growth in 2026 and expansion in aggregates cash gross profit per ton that continues to exceed historical averages.”