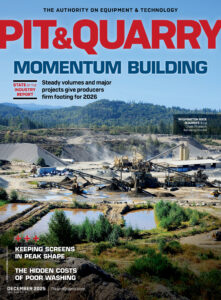

The construction aggregates industry entered 2025 on firmer footing.

After last year’s uneven finish, many equipment dealers began the new year with clearer demand forecasts. A year ago, dealers were sitting on a lot of inventory collected during the supply chain crisis following the pandemic.

This year, they’ve right sized – bringing the market back into a rhythm. That rhythm is steady rather than sensational – a welcome change for anyone connected to the industry’s supply chain.

For manufacturers, fewer speculative orders mean more realistic scheduling, better forecasting and healthier communication.

Finding steady ground

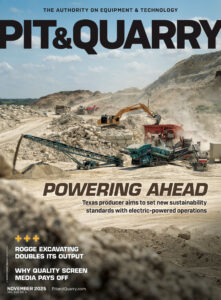

While activity varies regionally, the Southeast stood out in 2025 – with Florida and Texas being consistent drivers.

2025 may not have been a boom year, but it’s been a busy one. Projects are moving, and when opportunities surfaced, producers were ready to spend. Conversations with dealers are positive again, as well.

Broader market data supports this view. Infrastructure investment continues to stabilize demand across the public and private construction sectors, and producers appear to be spending with more confidence rather than caution.

From a manufacturer’s perspective, that sentiment matters as much as tonnage totals. When producers and dealers are confident enough to plan six months ahead, that’s a sign of trust in the industry’s direction.

Fortunately, interest rates – which continuously made headlines in 2023 and 2024 – have somewhat faded from daily conversation. They remain a consideration for financing, but concerns have settled down.

Even a small reduction in rates, combined with better inventory control, has made it easier for dealers to operate without the financial strain that defined the previous cycle.

What’s next

Looking ahead, the tone is one of steady momentum. Dealers are ordering more strategically, producers are maintaining activity and large projects continue to signal strength in underlying infrastructure demand.

Manufacturers aren’t chasing a surge. The market feels balanced, though – and that’s healthy.

Still, potential catalysts remain. Global trade conditions, including tariff policy and international steel supply, could influence equipment pricing before the end of 2025. And the possibility of a “double bump” – one where easing costs and renewed buyer confidence prompts additional purchasing among those who delayed upgrades last year – is very real.

For manufacturers, the message is clear: Consistency and service matter more than ever. With production steady and projects in motion, the industry’s next chapter will depend less on spikes in demand and more on reliability in performance and support.

The market looks stable, confident and active – good fundamentals for business growth. That stability lets everyone focus on what really counts: keeping the rock moving.

Jeff Gray is sales director at Superior Industries.