Terex briefed select members of the trade press on company developments during this year’s AGG1 Aggregates Academy & Expo and World of Asphalt in St. Louis. Among the company representatives on hand for the briefing were Pat Brian, vice president of Terex Aggregates; Kieran Hegarty, president of Terex Materials Processing; and Simon Meester, president and CEO of Terex Corp.

During an hourlong session, the three touched on topics such as the development of Terex’s Magna brand, opportunities to leverage AI and the state of the overall industry. The comments presented here were edited for brevity and clarity.

On a new Terex AI offering

BRIAN: Ask Terex is an AI application, but there’s a point of difference from using, say, ChatGPT. You can use ChatGPT to ask how to change a screen, and you probably will get some information. But Ask Terex is based on what we have in our own documentation. It’s multilingual. It’s super quick. We’re pushing that through our dealers.

On how the company anticipates users to engage Ask Terex

BRIAN: We launched the AI about six months ago. This is one of the ways we can monetize our digital offering, which has frankly been quite challenging up to now. We’ve had telematics on our machines, but we’ve struggled in some ways to really have customers determine the value.

It’s difficult to get skilled engineers in this very niche market that we’re in. This is our way of getting information to customers within seconds. It’s robust information based on our own technical knowledge, and it is self-learning. We see this as being part of the suite of our digital tools.

We basically sell the licenses to our dealers, and they can then sell those licenses on to their customer.

HEGARTY: It’s a complete aggregation of all our data from the helpdesk that we’ve had for years. What we want to do is differentiate our dealers from competitor dealers and give them the right tools.

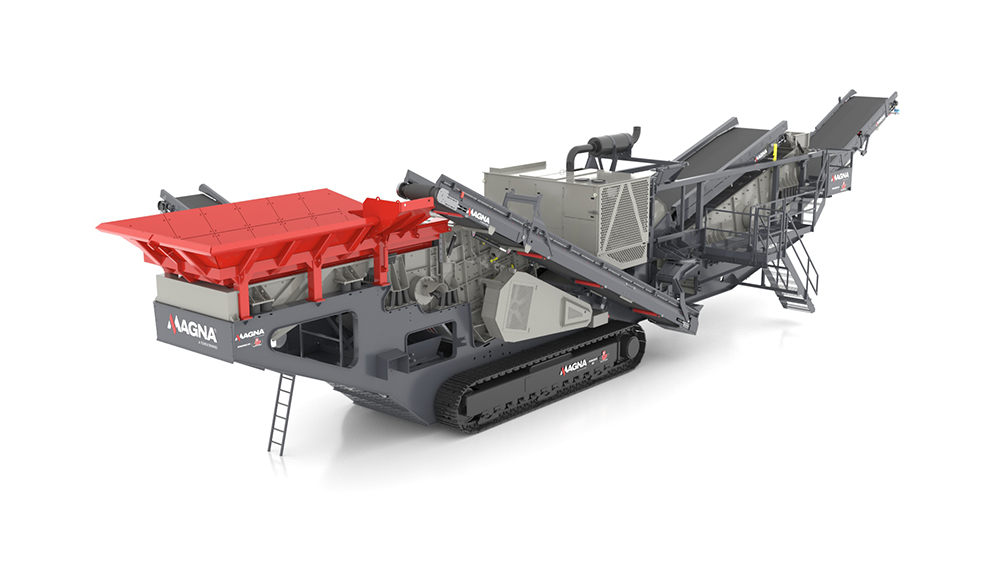

On Terex’s Magna brand

HEGARTY: The Magna brand is starting to gain a bit of healthy traction.

The aggregate space serves everything from contractors to small sand and gravel [producers] to the large quarry. We’ve been serving large quarries and large quarry companies for years. [Magna] is ultimately for the large producers.

BRIAN: We’re seeing mobile assets getting bigger, and that inflection point where someone puts in a stationary setup is changing a little bit.

Yesterday, we had a customer who was looking to put in a stationary plant. Hopefully, it’ll be a Terex one, but it’s likely to be three or four years before they’ve got all the permits and they’ve done everything that’s needed. But, they want to start producing now. They want high volume.

[With Magna], they can be set up within days. That machine can be operating in days, so they’re generating income while they’re waiting for the construction of the stationary plant.

HEGARTY: If you look at mobile crushing and screening as an industry, it’s relatively young. Crushing and screening has been around hundreds of years, but what’s happened in the last 30 or 40 years with mobile is plants have gotten bigger in their capacity. As Terex, whether it was our Powerscreen or Finlay brand, we were going out, in many respects, and trying to convert the market from what was traditionally stationary to mobile. And in order to do that, we would build bigger-capacity plants.

Twenty years ago, a large mobile produced 200 tph. Today, the mobiles are capable of producing 1,500 tph. You obviously can’t roll that on a trailer and drive it down the road to the next quarry. But it’s mobile in the sense that we can roll it out onto a site and be running in six hours.

On Terex’s Magna strategy

BRIAN: Our Magna strategy was informed by what we did with our compact equipment. We have a brand called EvoQuip. With that business, we skimmed off the very smallest machines within Powerscreen and Finlay – their bottom-end machines – and that got us some immediate traction [on EvoQuip]. But we supplemented that with building our own machines for EvoQuip. Additionally, we had partnerships with third parties, and all of a sudden, we had a range ready to go.

That kind of informed us at the other end with what we’ve done with Magna. Magna has machines that are only Magna branded, but Magna has also skimmed off some of the very biggest models from Powerscreen and Finlay.

HEGARTY: One of the things we’re trying to do is make sure we’re selling flexibility. You could be [on a site] for a year. If the market dies or you have another quarry elsewhere where there’s more demand, you can move the product and the process.

On Magna’s GIPO partnership

BRIAN: Through Magna, we hooked up with the Swiss manufacturer GIPO (Gisler Power). GIPO has an incredible reputation – predominantly in Europe – for high-quality, large impactor crushers.

Now, we don’t have a tracked impactor crusher of this size. Our discussions kind of started at Hilhead. Because GIPO has great resonance in Europe – a fantastic reputation – we said let’s co-brand this. And so, Magna and GIPO have come together. GIPO has a really strong presence in Europe, but it’s almost unknown outside of that.

North America is our biggest market. We’re hopeful that combining the GIPO machine with our distribution will be good news for them.

It won’t always fit all our traditional dealers. Some of our dealers might not want to [represent] a machine that costs $1.5 million. So, we need to make sure with Magna that we’ve got the right distribution strategy.

It’s not just about product. It’s who are the dealers and who’s going to be capable of servicing equipment of this scale.

On Magna products to come

BRIAN: Our biggest screen on a mobile chassis, now sold both through Finlay and Powerscreen, is a 6 x 20. Our Simplicity brand makes an 8 x 20, so one of the new products we’re going to launch on Magna [involves] an 8 x 20 on a tracked chassis. That will be completely unique. No one’s got that. Where we can, we’re trying to leverage our existing components.

Development time is always in the development of the vibratory screen or the crushing chamber. That’s much more difficult than, say, the plant design. So, if we can utilize existing chambers or vibratory screens and put them on a mobile chassis, then we’re in business pretty quickly.

On the market outlook for North America

HEGARTY: Honestly, we were quite bullish. The markets globally have been tough – particularly in Europe. You’ve had large countries like Germany, the UK and France – some of the big markets – that have been tough from a from a demand point of view.

A lot of our business is related to general construction. North America was fairly strong these last two years. I think the infrastructure spend and some of the large factory spend was particularly helpful.

The market was reasonably, what I would say, ‘stable.’ The outlook, at least talking to our distribution partners and customers, was a lot of positivity.

After [President] Trump [was elected], there was a lot of positive thinking from a business perspective. Obviously, we’ve gone into a period now where there’s a bit more uncertainty, given the change in dynamics around [tariffs] and are they on or are they off.

MEESTER: You have short-term projects that are interest rate sensitive and the kinds of projects that are not interest rate sensitive.

The public [market] is doing really well, and only one-third of the big government bills have been spent so far. That gives us a tailwind for a couple of years to come, especially on the infrastructure [bill] and the CHIPS Act.

With the Inflation Reduction Act, there’s a little bit of concern about some of that being undone by the Trump administration. But we think it will be replaced by some other things Trump wants to onshore.

The big unknown – and this applies to Terex businesses – is the private spend. Is that going to come back? That’s all dependent on interest rates and consumer confidence.

At the moment, we see the public spending projects keeping us going – and for a few more years to come. If the interest rates come down and confidence starts to pick up, then there’s upside for us.

Related: Check out other news and developments from AGG1 2025