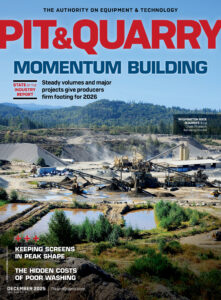

Allied Rock continues to expand its presence in Oregon, adding the South Rock Quarry near Salem in 2025. Company president Andrew Siegmund recently discussed the acquisition during a P&Q site visit. He also offered a market outlook and touched on emerging technologies shaping Allied Rock’s operations.

P&Q: Allied Rock acquired the South Rock Quarry in 2025. How did that deal come together, and what role does the site play in your portfolio?

Siegmund: We were fortunate to work with the landowner to acquire a long-term lease on this site. We see this quarry as one that’s going to serve the Salem metro market and the I-5 corridor. We came in quickly, started mining, built up feedstock and then moved in a screen plant and a crusher in early August. As soon as we acquired the quarry, we also transferred material from one of our other quarries so we could immediately start serving customers. Rock has been going out the gate every day since.

P&Q: Allied Rock has had success turning around its X-Rock Quarry site. What lessons from that operation are you applying to the South Rock Quarry?

Siegmund: We’ve gained a lot of experience with permitting and regulation, so that’s been a big help. We’ve also built a strong marketing plan. It’s really about meeting customers where they’re at, working closely with contractors, being plugged into the local market and knowing what projects are coming up. Sales don’t just come to you – you have to be proactive.

P&Q: From a growth standpoint, what do you look for in a prospective quarry site?

Siegmund: We’re looking for sites with defined markets they can serve and resources that match those markets. We’re not interested in acquiring quarries just for the sake of having them. We need to know there’s a customer base we can support. We like hard rock sites in particular. That’s what we know best – drilling, blasting and moving overburden.

P&Q: How would you characterize the business conditions here in 2025, and what do you expect as we head into 2026?

Siegmund: 2025 has been a decent year, but like everybody, we’re affected by interest rates. We need developers to develop, builders to build and homeowners to buy homes. Ultimately, we need an interest rate cut – that’s important for this industry. If that happens this fall, it could really kickstart 2026.

We’re also watching closely for an ODOT (Oregon Department of Transportation) funding package, which will be critical for infrastructure here in Oregon and the dollars that flow to cities and counties. Overall, we’re cautiously optimistic about 2026.

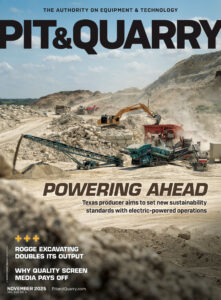

P&Q: You’ve also been active in adopting technology. What’s happening at Allied Rock on that front?

Siegmund: For about the last year, we’ve been working with OEMs on autonomous technology in our quarry operations. We’re looking specifically at off-road haul trucks, dozers and wheel loaders – repetitive tasks like load-haul-dump cycles or pushing up a stockpile. Those are areas where we don’t necessarily need a person and would rather put their skills into more critical functions.

Autonomy has been in the big mines for a long time, but AI is now bringing it to a scale where midsized contractors and smaller operators like us can use it. It’s an exciting time.