“For data centers, it’s estimated that 800 terrawatt-hours of compute power is going to be needed in the next 10 years. That’s the equivalent of 15 New York Cities when it comes to power. [In terms of] data center capex, we expect to approach $1 trillion a year before the end of this decade. Not only do we see a world where more electricity and energy [are] needed, it’s going to take a growing mix of energy sources.”

Joseph Creed, Caterpillar

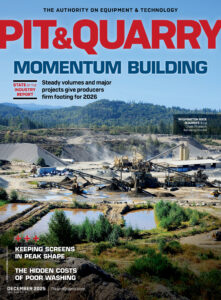

“For sand and gravel, the 2025 season was plagued with uncertainty. Building starts were slow, with interest rates certainly playing a role in delays on certain projects. Volumes were below last year. We were extremely busy from 2022 to 2024, however, so in some regard we are probably returning to normalcy in terms of volume. The fall of 2025 saw a rebound in sales through the last week of November. However, winter seems to have set in early, and that will impact December. We anticipate 2026 will be better than 2025, but not the volumes of 2022 to 2024.”

Stewart Petrovits, Route 82 Sand & Gravel

“When we look at our guidance, I think I’m very satisfied with the good demand we saw with our customers in Q3 – our first full quarter as Amrize. We see markets now have begun to stabilize, and we see significant pent-up demand backed by long-term megatrends. There are some uncertainties remaining with our customers. However, we are cautiously optimistic about our demand momentum to continue from now on.”

Jan Jenisch, Amrize

“It seemed like we were hot in the middle of 2025, and then it slowed down a little. It got hot again at the end of the year, which is good. But we weren’t concerned because our backlog was already pretty well backfilled.

Kirby Cline, Masaba

“I believe we need to see the Americans who need to buy a house to emotionally understand that mortgage rates might not drop significantly sooner. That might trigger the need to jump and purchase a house. I don’t think that’s going to happen in the short term in 2026. I’m still expecting a stabilizing, though, but a weak residential. I hope to see that recovery in 2027. I do expect U.S. demand to grow next year – in the low-single-digit [range], though.”

Jamie Muguiro, Cemex

“One opportunity is the ongoing funding provided by the current federal highway bill in the United States. Multiyear commitments for federal road and bridge projects provide stability for Astec’s customers, many of which have reported substantial backlogs of work. In addition, the demand for aggregate, concrete and asphalt used in other public, residential and nonresidential construction projects is encouraging.”

Jaco van der Merwe, Astec Industries

“The overall market remains very strong. I think it’s been that way now for a while. I think it’s supported by the IIJA (Infrastructure Investment & Jobs Act) and our private markets. We’ve seen that consistent theme now for a few years, where we’re just bidding more work – more procuring work – and the margin associated with that work continues to improve.”

Kyle Larkin, Granite Construction

“Construction markets are expected to experience modest growth, supported by employment at all-time highs and construction backlogs at robust levels. U.S. government infrastructure spending continues to bolster the industry. Additionally, declining interest rates, increasing investments in rental fleets and surging data center construction starts are also providing support.”

Christopher Seibert, John Deere

Related: Perspectives: Building momentum into 2026