“We believe we are still at the beginning of what looks to be a long period of growth in the construction industry. The roads, bridges and airports that are so vital [to] our economy need fixing, and that doesn’t happen overnight. We expect to continue benefiting from the buildout of the nation’s infrastructure for years to come.”

– Brian Gray, Knife River Corp.

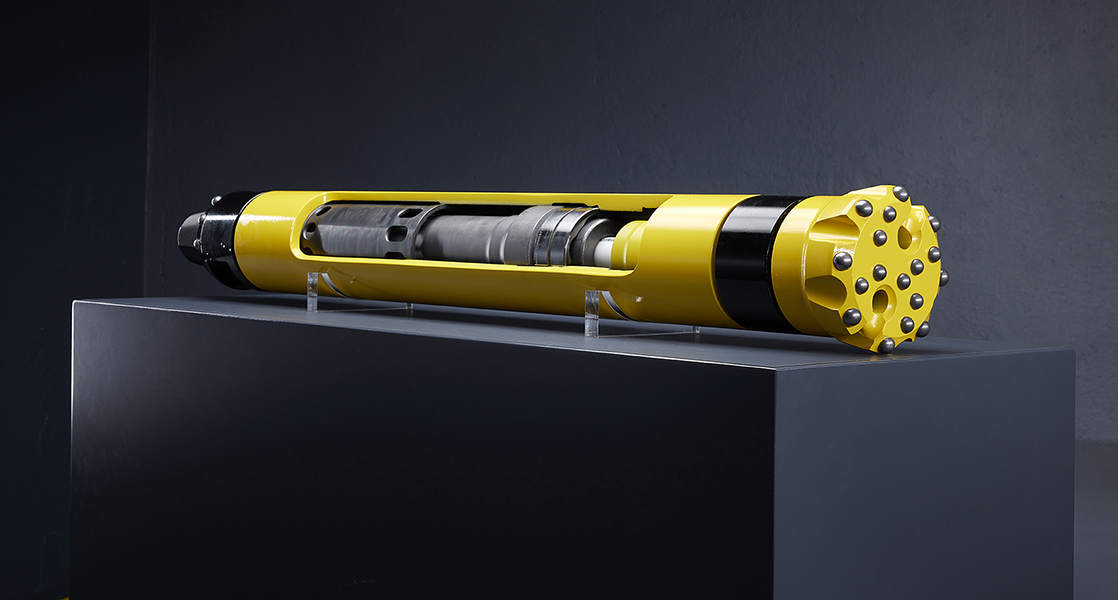

“From our vantage point, the aggregates industry is poised for steady growth in 2025, driven by strong infrastructure investments, enhanced material pricing and an election in the rearview mirror. TCI is coming off a record year, and we are particularly optimistic with a robust backlog of orders. Our customers are seeing sustained demand, which is driving plant expansion and new site development. This promising environment sets the stage for continued success for TCI and others in the aggregates sector.”

– Kelan Moylan, TCI Manufacturing

“We are a family company with a couple mines, as well as some ready-mix plants in west central Ohio. We have seen an incredibly positive shift since November in optimism from not only our commercial customers, but residential as well. It is evident that in our market the consumer sentiment is positively aligned with the incoming administration. Personally, I look forward to and am very excited to hear what’s in store in the coming weeks on infrastructure.”

– Ross Duff, Duff Quarry

“We are expecting slight recovery in 2025 as a result of the interest [rate] cuts. I’m confident that North America will continue to be robust, driven by all these federal and state investments. … We have already secured 150 mid- to large-scale projects in [the] U.S. that are related to [the] Inflation Reduction Act, IIJA (the Infrastructure Investment & Jobs Act), chipset and so on.”

– Miljan Gutovic, Holcim

“Looking at our parts business, it’s very clear that our customers are running our equipment. Quoting activity is good. We’re cautiously optimistic about [2025] based on the feedback we get from our dealers.”

– Jaco van der Merwe, Astec Industries

“2024 was a very good year for South Carolina, which is among the fastest-growing [states] by percentage of population in the United States. It’s a growth state for a lot of our companies. They recognize there’s so much potential here.”

– Jessica Palmer, South Carolina Aggregates Association

“While we continue to navigate some challenges, we are encouraged by the signs of stabilization and recovery across our U.S. markets. Looking forward, the recent decision by the Federal Reserve to begin cutting rates marks a pivotal moment. We expect this to continue driving demand recovery in the coming months, creating a more favorable environment for growth in our core markets.”

– Enrique Escalante, GCC

“Our portfolio of strong businesses will continue to benefit from megatrends, onshoring, technology advancements and federal investments, including the Infrastructure Investment & Jobs Act, Inflation Reduction Act and the CHIPS Act. This legislative environment is driving record levels of megaprojects in data centers, EV and battery manufacturing plants, semiconductor plants and others, with more projects expected to come online from 2025 through 2027.”

– Simon Meester, Terex Corp.

“For [2025], we see high-single digits on aggregate price increases and low-single digit on asphalt. And it really gives us confidence, as we have high confidence in the public market. We get really good visibility into that with the funding that’s out there.”

– Kyle Larkin, Granite Construction