We are going to hear a lot about New Monetary Theory over the next few years. This theory will directly impact aggregate consumption due to more stimulus spending.

I know what you’re thinking: An economist always tries to make everything about economics. But the next major stimulus bills that are passed – and it seems more are likely now – will justify the bills based on infrastructure needs and New Monetary Theory.

The short version of the theory says government deficits don’t matter, as long as inflation stays low. Therefore, if we have current needs, spend now and don’t worry about the debt. This sounds pretty good, but just remember the “as long as” phrase in the definition.

What to know

We are now on a new path for the economy and construction.

We have several vaccines, we have trillions of new dollars floating around, and we have a new political direction. All point to more spending and to higher construction growth. The impact will be muted for most of 2021, but it will really kick in by the end of this year.

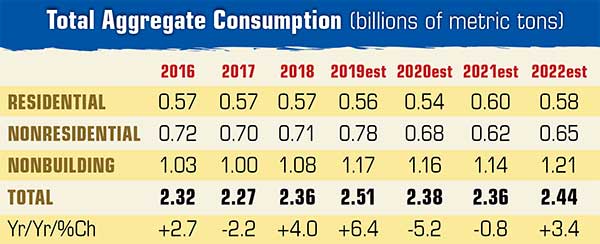

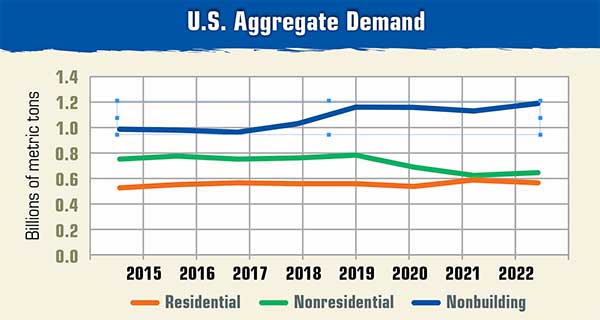

The biggest change in the outlook is the stronger outlook for nonbuilding. While most of the new spending will be for non-infrastructure, enough will find its way into this segment to provide a substantial boost to aggregate consumption.

Even nonresidential will be boosted by 2022 as the pandemic fades into history and more normal work patterns return. The work patterns will not completely return to pre-2019 levels due to the structural changes embedded in our culture now.

Regionally, the colder states and the West Coast will do better than the prior outlook because they will get bailed out in the new spending bills coming through Congress. Even so, the rapid growth areas remain the Sun Belt and Mountain states.

Locally, the suburbs will continue to account for the majority of new housing, as lower density will continue to be desired.

Aggregate pricing strength will return by late 2021 in most areas.

David Chereb, Ph.D., is with David Chereb Group (DCG), which produces customized market forecasts by major segment of construction, from the county level up. Clients use DCG market intelligence reports for business planning and acquisition analyses in aggregate, ready-mixed concrete and cement. Visit davidcherebgroup.com for more information.