Another stimulus is coming soon, and infrastructure spending could be right behind it.

The money spent so far has helped workers and businesses stay afloat, and it has really helped Wall Street and home prices. As we look to the end of 2021, things will begin to look quite different.

Some things are very likely. The economy, for example, will grow at above-average rates – with GDP near 4 percent – and homebuilding will lead all construction categories.

Other things are not so certain, though, including an infrastructure bill, increasing international tensions, and states’ rights versus federal-supremacy conflicts.

Concerning infrastructure: If a bill had been first in line this year, it would pass easily. But coming after almost $5 trillion in rescue/stimulus spending for 2020-21, it will now be more difficult to get an infrastructure bill through Congress. Our bet is for a modest increase from current levels and proposals to change the entire gas tax method of funding roads.

Segment by segment

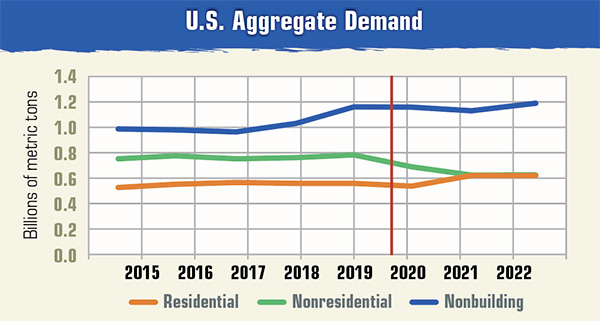

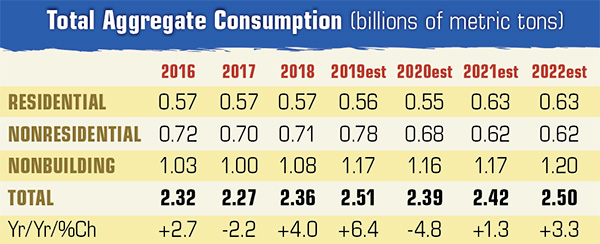

Housing is entering another boom phase, with demand rising and mortgage rates remaining at record-low levels. Still, all of this will change before the end of the year as mortgage rates increase and new buyers are priced out of the market. Housing will peak in 2021 and plateau in 2022 before declining in the years that follow.

Nonresidential construction, which has been hit the hardest by the pandemic, is not out of the woods yet. Large mortgage defaults are growing, and not until we return to “normal” can this segment grow. Because we are an innovative people, we expect solutions will be found and that this segment will grow modestly by 2023.

Nonbuilding construction has held up amazingly well during the pandemic, and it will continue to hold up as state and local revenues do better than forecasted six months ago. Most states – but not all – will be able to fund more infrastructure work by 2022.

Aggregate pricing strength will return by late-2021 in most areas.

David Chereb, Ph.D., is with David Chereb Group (DCG), which produces customized market forecasts by major segments of construction, from the county level up. Clients use DCG market intelligence reports for business planning and acquisition analyses in aggregate, ready-mixed concrete and cement. Visit davidcherebgroup.com for more information.

Featured photo: P&Q Staff