In mid-March, the Federal Reserve raised interest rates by 0.25 percent – into a range of 0.25 to 0.5 percent – in an effort to curtail inflation. This was the first time the Fed raised rates since December 2018.

In addition to raising rates at the last meeting, the Fed indicated that more rate hikes are likely coming this year with the goal of reaching 1.9 percent by the end of 2022. Rising rates increase the cost of financing equipment purchases and taking out mortgages on homes. Construction materials firms with residential exposure are more vulnerable to interest rate changes.

Sentiment indexes and backlogs

Despite all of the headwinds on the horizon, industry sentiment remains positive.

Both the Heavy Civil Construction Index and the Nonresidential Construction Index (NRCI), FMI’s two proprietary indexes that measure construction outlooks, earned scores of 57.7 and 53.8 in the second quarter of 2022, respectively. A score above 50 indicates expansion, and a score below 50 represents market contraction.

The one caveat is that the second-quarter 2022 score for the NRCI was lower than the previous quarter’s report, which coincides with the cautiously optimistic undertones in the market. Additionally, backlogs, which are a health indicator in the construction industry, appear to be trending at near-term historic averages according to the Associated Builders & Contractors. Overall, sentiment and data point to near-term optimism.

The CMI

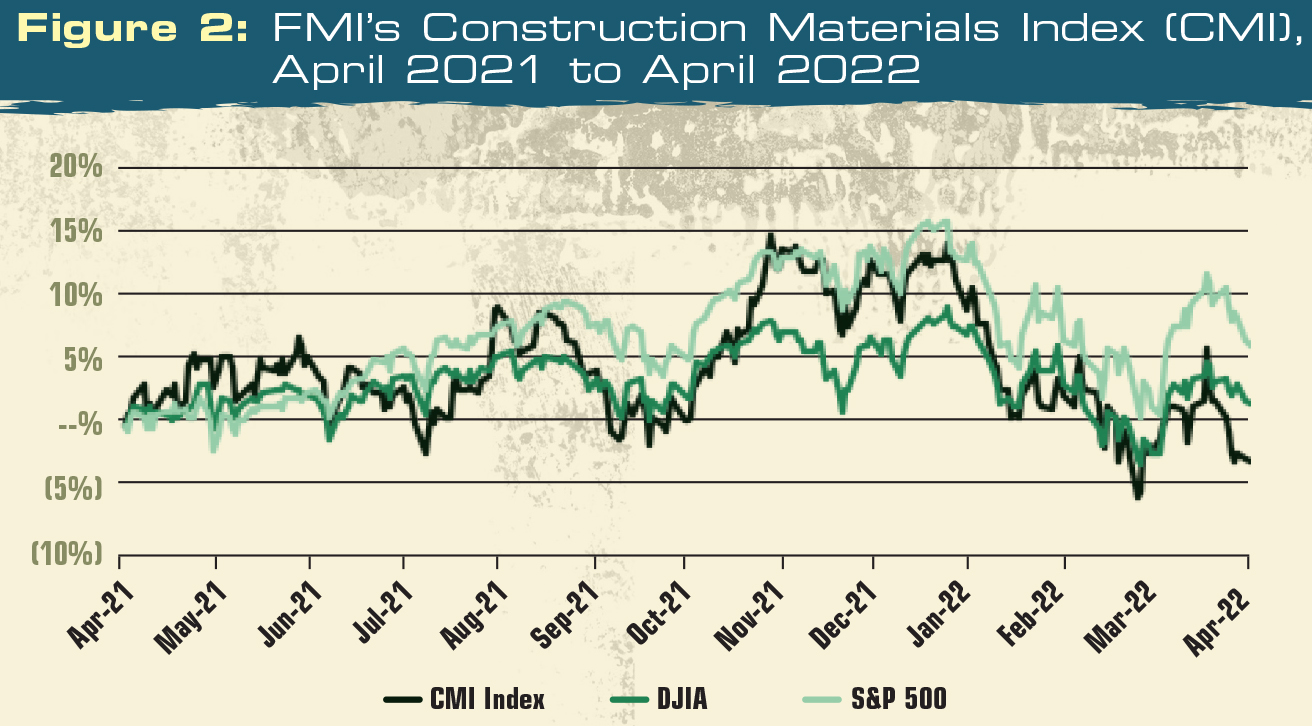

The Construction Materials Index (CMI), FMI’s proprietary index of publicly traded construction materials companies, ended 2021 on a high note with most companies hitting or exceeding top- and bottom-line analyst expectations for the fourth quarter of 2021. Still, strong operating results do not always translate to stellar stock performance.

The CMI has lagged the broader indexes over the last 12 months. The downward pressures weighing on the CMI include high input costs due to inflation and issues brought on by supply chain constraints.

Additionally, six of the companies that make up the CMI are headquartered in Europe, and the war in Ukraine has created immense uncertainty leading to fluctuations in the equity markets. As a result, it will be very interesting to review earnings reports in the upcoming quarters.

Will CMI companies be able to maintain margins and pass on costs to customers? Time will tell.

M&A activity

The momentum of a strong operating year in 2021, combined with the passage of the IIJA, continues to fuel M&A transactions in the construction materials space.

2022 is on pace with some of the stronger years for M&A. FMI anticipates a robust year for M&A in the space due to the supply-and-demand dynamics between buyers and sellers.

Buyers have cash, borrowing capacity and expectations for continued strong earnings. Sellers, particularly family-owned businesses, face generational pressures and are concerned about missing the window of opportunity to exit.

Keep in mind, too, that buyers face human capital limitations in both pursuing deals and integrating acquisitions. Therefore, FMI believes both public and private construction materials companies will pursue logical M&A targets that possess achievable synergies in strong markets. The upcoming earnings season will be a great indicator for near-term M&A expectations.

Conclusion

After weighing the pros and cons, there is still momentum for the construction materials industry. Historic federal funding for roads and bridges combined with a strong near-term outlook for the residential sector should boost construction materials through this period of tumultuousness. As public companies report their first-quarter earnings, we will see how impactful some of the potential “roadblocks” have been for the sector.

George Reddin is a managing director and Rob Mineo is a director with FMI Capital Advisors.

Featured photo: P&Q Staff