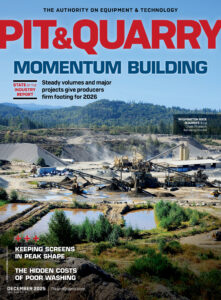

While 2025 may not have been a gangbusters year for aggregate producers, business was generally very good overall for most.

Infrastructure projects propelled production, with megaprojects supplementing it. Each market, of course, has unique dynamics, but aggregate demand remains in a historically high standing nationwide.

Still, aggregate producers everywhere want more. Specifically, they’re ready for the residential construction market to finally get going.

“2025 has been a decent year, but we’re really – like everybody – affected by interest rates,” says Andrew Siegmund, president at Oregon-based Allied Rock. “We need developers to develop so builders can build, and we need homeowners to buy homes.”

Other perspectives

Chris Williams, vice president of operations at Missouri-based Capital Aggregates, couldn’t agree more about housing. It’s churning the least of the big three construction markets.

“Residential construction has been spotty – if not down – across the board,” Williams says. “We’re fortunate in the places we operate that there’s generally a lot of infrastructure investments. We’re cautiously optimistic, though. I think that’s what everyone is saying these days.”

Matt Konjevich, operations manager at Melvin Stone Co., has a similar view from his spot in Ohio.

“I’m hopeful that interest rates begin to drop,” Konjevich says. “That’ll help the housing market out, and we’ll start to see more residential construction.”

Fortunately, those other key construction markets are propping producers up these days.

“Where we see most of our business going is DOT projects – roadbuilding and bridge building,” Konjevich says. “A lot of it’s also [projects like] data centers that are driving a very big portion of our business.”

Dallas-based United States Lime & Minerals (USLM) is another producer touting data centers as a tremendous 2025 demand driver.

“Demand from our construction customers remained solid, supported by the construction of large data centers in the regions that we serve,” says Timothy Byrne, president and CEO of USLM.

2026 views

Demand opportunities in nonresidential and infrastructure are also present in Washington state, according to Washington Rock Quarries president Jonathan Hart.

“We’ve seen a lot of warehouse-type projects going on locally,” Hart says. “We see a lot of big highway projects coming up. We know we have some new highway construction coming up over the next three to five years.”

The outlook is also positive in Ohio, where a record 710 people registered for last month’s Ohio Aggregates & Industrial Minerals Association Annual Meeting.

“That participation is a direct correlation to the health of the industry in the state,” Konjevich says. “When you’ve got a lot of people participating in the association, your voice for the industry is greater.”

Heading into 2026, CRH’s Jim Mintern is among those with a rosier outlook.

“Looking ahead to 2026, we expect favorable market dynamics and the continued execution of our strategy to underpin another year of growth and shareholder value creation,” says Mintern, CEO of CRH.

Managing editor Jack Kopanski contributed to this article.