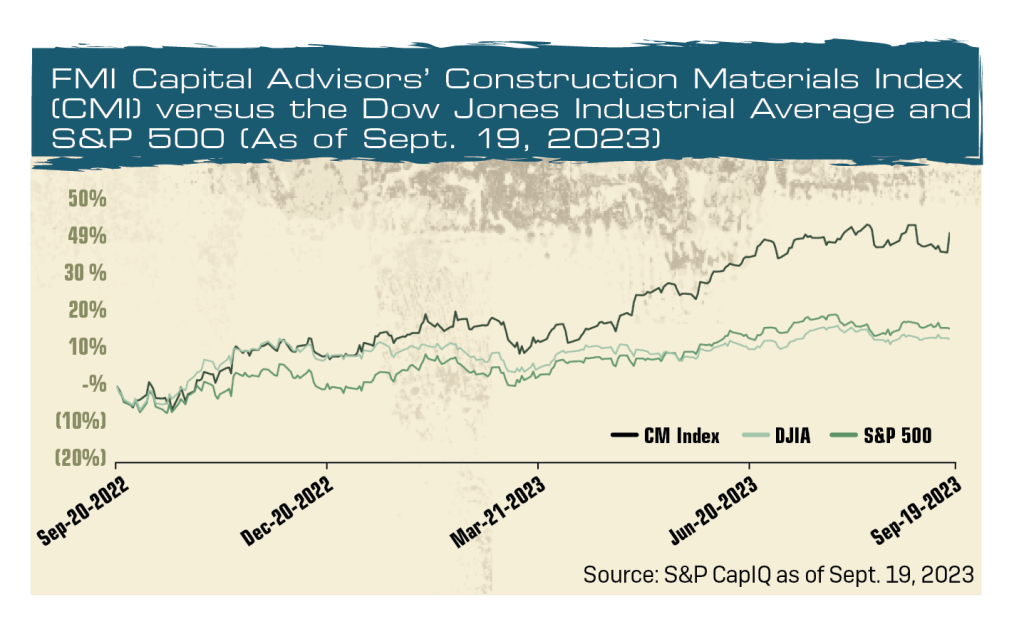

In our latest review, we see that the Construction Materials Index (CMI) continues to outperform the major indices – although the gap has normalized and slightly narrowed.

Investors have likely priced in the sector optimism and are taking a “wait-and-see” approach as the general economy continues to navigate through global uncertainty.

As we wrap up the third quarter, the October and November earnings reports will be very interesting to monitor. We will hear if construction materials companies were able to maintain their strong performances.

The CMI is a proprietary index of 18 publicly traded companies that operate in the construction materials space. FMI’s CMI includes Arcosa, Buzzi Unicem, Cementos Argos, Cemex, Colas, Construction Partners Inc., CRH, Eagle Materials, Granite Construction, Grupo Cementos de Chihuahua, HeidelbergCement, Holcim, Knife River Corp., Martin Marietta Materials, Summit Materials, The Monarch Cement Co., Titan Cement International and Vulcan Materials Co.

George Reddin, Rob Mineo and Evan Coughlin are with FMI Capital Advisors.

Related: Making sense of construction materials right now

Featured photo: P&Q Staff

![Says BMC Enterprises’ Nathan McKean: “We’ll do pure ready-mix deals and pure [aggregates] deals, but it’s aggs first.” Photo: BMC Enterprises](https://stage.pitandquarry.com/wp-content/uploads/2023/09/PQ1023_biz-bmcenterprises-feature736x375.jpg)