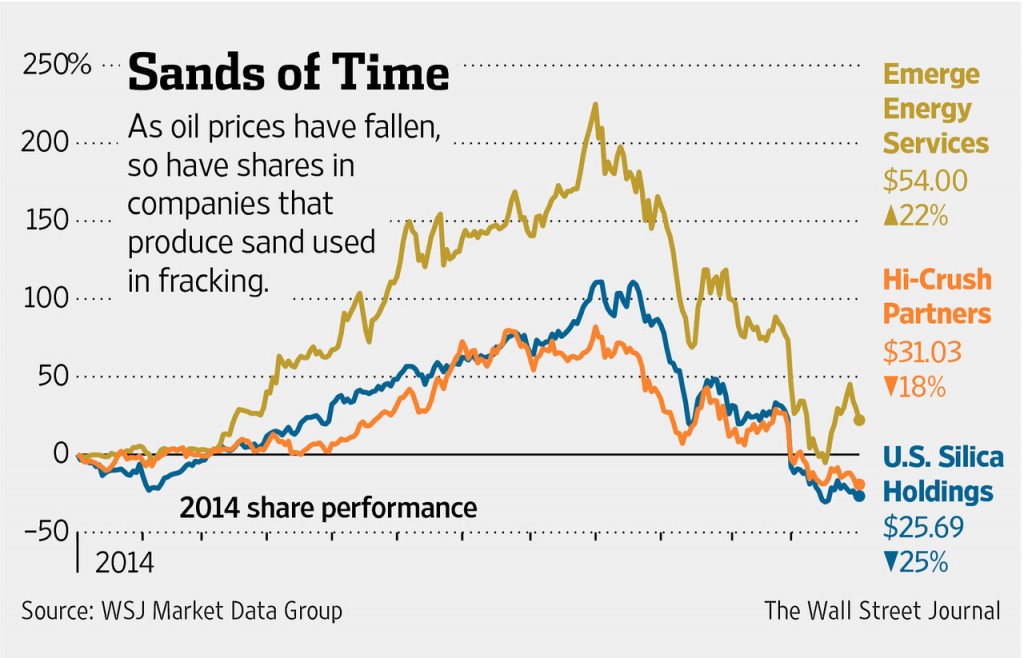

Earlier this fall PacWest Consulting Partners, a company that forecasts sand demand, projected sand use would grow by 20 percent in 2015. However, now that oil prices have fallen, many sand fracking companies are retrenching, says an article in The Wall Street Journal.

PacSand now expects sand demand to stay flat.

According to the article, new sand mines could add another 10 percent on top of the existing pile, decreasing frac sand prices even more.

Despite this, U.S. Silica Holdings’ Chief Executive Bryan Shinn says he still expects growth in 2015 and job cuts “aren’t in the cards” for his company.

Chief Executive Rick Shearer of Emerge Energy Services, another sand company, also acknowledges the challenges his company faces due to the decrease in oil prices.

“Lower oil prices are a concern,” he says. “This adds a lot of uncertainty to 2015.”

According to WSJ, Emerge Energy made its debut on the stock market at $17 in May 2013 and soared as high as $145 in August. Today it trades around $54.

FMSA Holdings, the holding company for Fairmount Santrol, an Ohio-based sand miner, also experienced a fall in stock price since the oil price decrease. According to the article, the company’s stock price has fallen more than 55 percent since the company went public in October. However, Jenniffer Deckard, the company’s chief executive, says Fairmount Santrol is familiar with energy market cycles.

“We have managed through these cycles before,” she says. “We are again working closely with our customers to understand both the short-term impact and looking at long-term opportunities.”