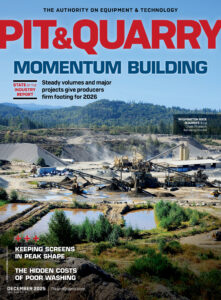

Even in a somewhat flawed economic environment, equipment manufacturers and dealers tend to benefit when the market fundamentals work in favor of aggregate producers.

In 2025, that connection was on full display.

“This year reflected solid fundamentals across the North American aggregate sector despite inflation and cost pressures,” says Karen Thompson, president of Haver & Boecker Niagara’s North American, United Kingdom, Ireland and Australian operations. “Demand held steady across the board as infrastructure and construction projects moved forward. We saw our customers focusing on reliability, plant optimization, data and diagnostics to improve uptime and extend the life of their equipment.”

Other manufacturers experienced these market conditions – including Masaba, whose president, Mike Krajewski, characterizes 2025 as “solid.”

“We had a couple of slow months in the middle of the year,” he says. “Certainly, I think everyone understands how the tariffs created a lot of economic uncertainty – not only in our industries, but others. Still, we’ve had a really strong year.”

Philippi-Hagenbuch – yet another manufacturer – had a similar 2025 experience.

“2025 marked a nice uptick in capital investments from the aggregates industry after a slower 2024,” says Josh Swank, chief growth officer at Philippi-Hagenbuch. “We saw a strong year coast-to-coast in the United States, which resulted in high demand for our products throughout 2025.”

Dealer perspective

Similarly, equipment dealers have positive reflections as they look back on the year that was.

US Equipment Sales & Rentals, which operates in the Midwest, benefited from healthy construction activity in the infrastructure and residential sectors. Bob Meyers, vice president of sales at US Equipment, says his company has experienced five consecutive years of “really good growth” – and he’s optimistic about the years to come.

“I hope the funding continues to roll out,” he says. “Not only for highways and homebuilding, but airports and other infrastructure. AI is going to need big facilities. That’s going to serve our industry very well. I also like the way the different interest rates have gone.”

Power Equipment Co.’s Marc Dowdell, another dealer serving parts of the Midwest but also the Rocky Mountain region, describes business in 2025 as “robust.”

Like Meyers, he points to the Infrastructure Investment & Jobs Act as the force providing decision-makers with the long-term confidence to pursue capital expenditures.

“Most producers have a healthy backlog of work,” says Dowdell, president of Power Equipment Co. “We’re bullish right now. There are some headwinds with tariffs and world affairs, but the market regionally has been steady.”

While this year may not be a record-setter for companies across the aggregate space, Dowdell offers a reminder that 2025 is one of the best equipment manufacturers have experienced over the last half-century.

“If you look at data for the last 50 years, the biggest years for equipment were pre-COVID – 2017, ’18 and ’19,” he says. “If you look at data from the last three years, they would rank right behind those. So even though people say we’re down from the peak, we’re still at a level that would be a record year except for those three years.”

Investment meets demand

Demand for equipment is also driving supplier facility expansions – including at Power Equipment Co. and Masaba, where major upgrades are taking effect this year.

Power Equipment Co. established a new headquarters in Brighton, Colorado, where it has centralized dispatch and streamlined work orders. Masaba, meanwhile, expanded its fabrication capacity in Vermillion, South Dakota, with a new facility featuring cutting-edge tech.

In Masaba’s case, the investment also stems from an increased demand for custom equipment.

“From what I’ve seen over the last year and a half, the standard [equipment] isn’t enough,” Krajewski says. “We’re doing a lot more custom work and a lot more project-based work. A big part of the decision to build this facility was because of that. It’s increased our capabilities to handle more of that volume – the larger projects.”

Managing editor Jack Kopanski contributed to this article.

Related: Industry leaders still clamoring for more residential activity