The U.S. economy is once again growing rapidly. Even with slower population growth and little change in the labor participation rate, the economy is growing at more than 3 percent per year.

The dual increase in both business investment and productivity gains are fueling the new growth. Behind these direct contributors are lower taxes, less regulation, more energy production and a pro-business atmosphere in many areas of the federal government.

Combined, these changes, which began with the 2016 election, create an environment that can handle higher interest rates and higher wages.

Unfortunately, all the headwinds we’ve discussed during the past year remain with us and could produce an unwelcome shock during the next few years. But as of now, the economy can remain on a 3-plus percent growth path for several more years.

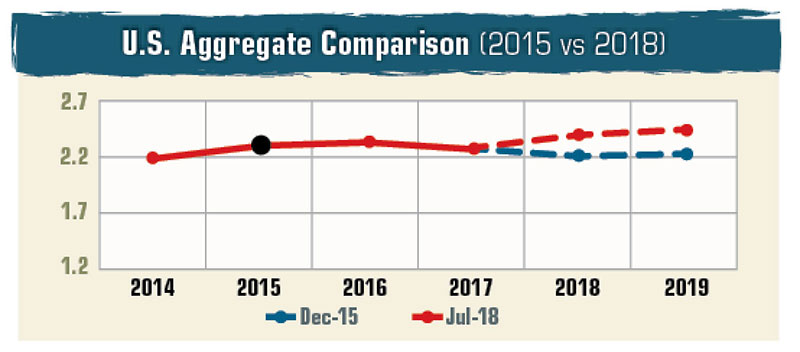

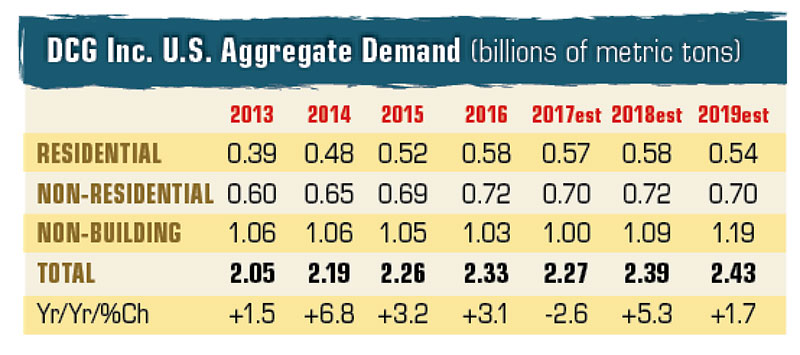

This means our outlook for construction materials remains favorable. Nonbuilding remains our strongest near-term segment and accounts for most of the increases through 2019. Most state tax receipts have been higher for several years in a row – just what is needed to fund more infrastructure.

While residential and nonresidential are both stronger than a few years ago, they are close to near-term peaks as high prices and higher financing costs inhibit some new demand.

Regionally, all areas are doing well. However, high-cost, high-tax states are beginning to show signs of slowing while other states continue on a higher growth path. Energy states are looking stronger as are manufacturing states.

Dr. David Chereb has many years of experience forecasting construction materials, and his web-based forecasting models have captured every major turning point in materials demand for more than 15 years. Chereb received his Ph.D. in economics from the University of Southern California.