While labor shortages may plague the industry into 2022 and beyond, the industry has managed to plow through those and supply issues to yet another productive year overall.

“As people in industries, we’ve learned to adapt,” says Mark Krause, managing director of North America at McLanahan Corp. “We adapted to [COVID], and we’ll adapt to whatever else comes our way.”

Cory Jenson, McLanahan’s executive vice president of sales and business development, echoes Krause’s sentiment.

“Overall, McLanahan is very happy with how things are going,” Jenson says. “The industry seems to be strong from a demand standpoint. We could deal with [fewer] supply chain issues but, obviously, everyone is feeling that.”

Supply pains aren’t limited to North America, either. According to Jenson, the challenges familiar at home are common around the world.

“We’re in Latin America, Europe and Asia,” Jenson says. “Pretty much everywhere, you don’t know what you’re not going to have tomorrow. You can have suppliers who will call up and say: ‘Hey, unless you’re willing to pay more for this, we’re shipping it to somebody else.’”

With dynamics like that, manufacturers, dealers and producers are continuously evaluating their inventory.

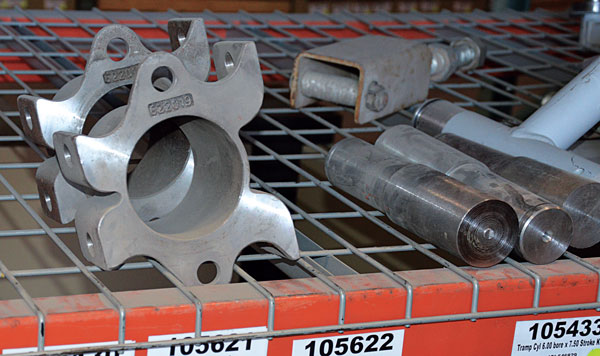

“We’ve tried to up our inventory a lot, and we have upped our inventory strategically to try to keep things for customers,” Jenson says. “Other companies are doing that, as well.”

RB Scott is one of them.

“I’d rather you told me we’re a little overstocked than we don’t have it,” Mickelson says.

Thinking bigger

One silver lining of today’s supply issues is that producers, in some respects, paused to evaluate “the big picture.” Kenyon explains.

“If we don’t have access to something, somebody else doesn’t either,” he says. “Customers, while they’re not happy with this, understand what’s going on.

“What we’re trying to do to keep them up and running is solve the root cause of the problem, rather than just replace a component,” he adds. “If a bearing goes on a piece of equipment, we’re not just replacing the bearing. We’re trying to do a root cause analysis of what caused the bearing to fail so they can take action and get the full life of their equipment. This increases their reliability while decreasing maintenance and dependence on the supply chain.”

More producers are especially willing to evaluate the “big picture” if a short-term fix isn’t an option, according to Kenyon.

“In this supply chain environment, many are forced to do the analysis,” he says. “It’s very easy to replace what was already there, making that decision and comparing prices on components. But when they’re faced with an issue and what they want is no longer available – and they’re trying to plan through the supply crisis over the next 12 months – we can give them multiple solutions.”