Despite rainclouds, the first quarter of 2023 was all about price increases. These ultimately boosted earnings.

Vulcan Materials’ year-over-year adjusted pricing improved 19 percent for aggregates, 15 percent for asphalt and 12 percent for ready-mixed concrete. Martin Marietta noted on its first-quarter earnings call that shipments were down for aggregates, asphalt and concrete. Pricing, however, was up 19.6 percent for aggregates, 9.9 percent [for asphalt and 20.2 percent for concrete.

Ward Nye, chairman, president and CEO of Martin Marietta, indicated that the company’s teams are actively advising customers of midyear price increases. The company anticipates these will be more widely accepted and larger in scope and magnitude than initially considered a few months ago.

Investors, meanwhile, applauded the first-quarter performances of construction materials producers. Most publicly traded industry companies beat Wall Street analysts’ expectations for both the top and bottom line.

FMI’s Construction Materials Index (CMI), which is up almost 14 percent on the year, reflects this notion. The CMI is well above the returns for the broader indices, thanks to stable funding and stellar company performance.

Inflation

Still, inflation and the Fed’s response continue to make headlines.

The April Consumer Price Index, a mainstream barometer for inflation, was up 4.9 percent – still well above the Fed’s target of 2 percent. To combat inflation, the Fed has raised interest rates three times in 2023 for a combined 75 basis points.

Rate hikes appeared to still be on the table based on the May Fed meeting. Take what Fed chairman Jerome Powell said afterward: “People did talk about pausing, but not so much at this meeting. … We feel like we’re getting closer or maybe even there. … [But] we are prepared to do more if greater monetary policy restraint is warranted.”

For construction materials, industry cost pressures are moderating but they remain elevated. Several construction materials companies noted increasing fuel costs brought on by OPEC+ production cuts, expensive equipment rental and repair, and the continued high cost of labor during their earnings calls.

The Bureau of Labor Statistics’ Producer Price Index for net inputs to construction shows slight cost decreases over the last 12 months. While encouraging, input costs remain well above pre-pandemic levels and construction materials providers should remain vigilant.

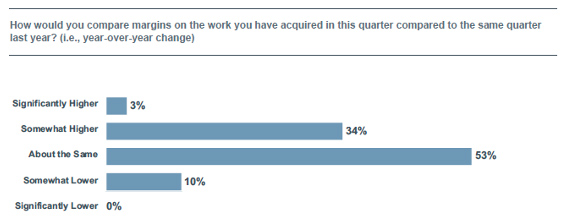

One key to the industry’s effectiveness is maintaining margins. As seen in FMI’s second-quarter 2023 Heavy Civil Construction Index, most respondents reported similar margins compared to the same quarter last year – and more than one-third are seeing margin improvement.

This is telling for two reasons: First, it signifies that companies were successful in passing on price increases. But it also speaks to moderating inflation. It seems the industry’s expectations and handling of inflation are finally paying off.

Residential outlook

The U.S. residential construction market appears to be in the midst of a correction thus far in 2023, but two fundamentals remain compelling: strong demand and low inventory.

“Affordability is the fundamental driver of the declines in single-family activity,” says Tom Hill, chairman and CEO of Vulcan Materials.

The combination of elevated interest rates and competition has likely priced homebuyers out of the market – for now. But there’s still an entryway for those interested in purchasing a home.

“If somebody does want a home at [either higher or lower price points], new construction is where they can find it right now,” says Jessica Hansen, vice president of investor relations and communications at D.R. Horton, during an April earnings call.