With the passage of the United States-Mexico-Canada Agreement and gains in China trade negotiations, the outlook for the industry is somewhat stronger.

The slowdown in manufacturing should be turned around sometime during 2020, eliminating another drag on growth. With excellent consumer conditions, GDP growth is moving closer to 3 percent than the 2 percent that seemed likely a few months ago. With mortgage rates still low, employment growing, and state and local tax receipts healthy, the stage is set for higher construction spending in all major segments for the first time in four years.

Geographically, no region is declining even though a state or two may be flat to slightly down. With energy prices higher than last year, the Energy Belt is recovering and the Rocky Mountain states are attracting many new businesses and families.

Population movement continues from north to south, bringing construction changes with them. Residential is getting stronger as the long bull market and many years of personal income growth are enough to overcome the structural change of millennials’ lower desire for owning a home.

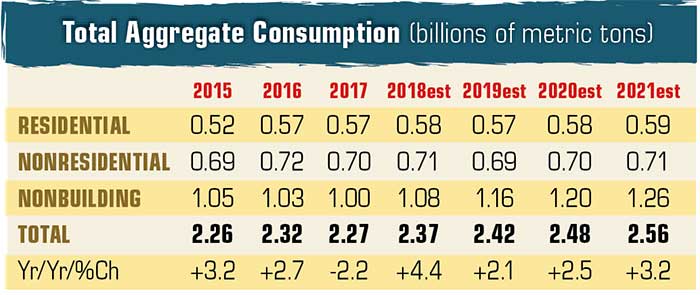

The demand for new shopping square footage remains on a downward path, as the Amazon effect continues and will persist for a few more years. New warehouse and office demand are helping to stabilize this segment. Nonbuilding (i.e., roads, bridges) remains the strongest segment and will continue to grow for several more years.

While the probability of major new federal spending remains low, it is growing as we head toward 2021. The 2022 to 2025 period should be very strong for this segment.

The default outlook is for continued growth in aggregate demand and solid gains in pricing.

Dr. David Chereb has many years of experience forecasting construction materials, and his web-based forecasting models have captured every major turning point in materials demand for more than 15 years. Chereb received his Ph.D. in economics from the University of Southern California. He can be reached at david.chereb@sc-marketanalytics.com.