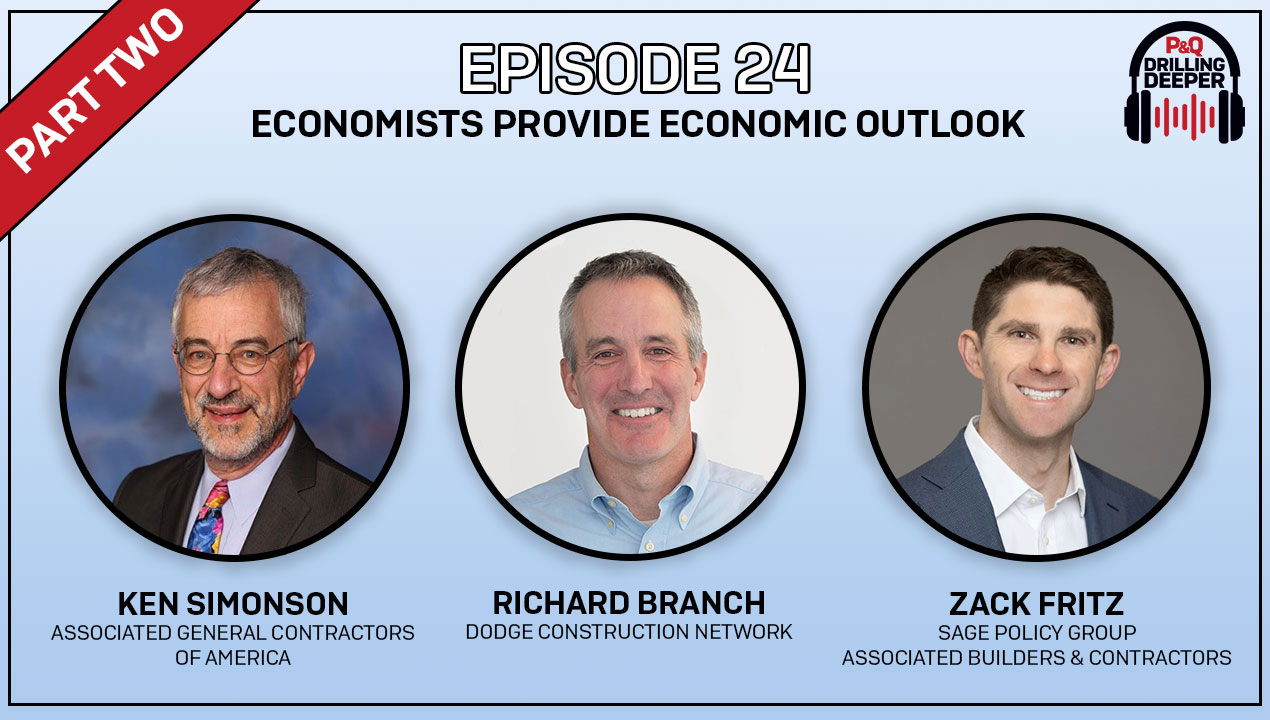

Richard Branch, chief economist at Dodge Construction Network, details how the presidential and congressional elections will impact construction markets in the new year and beyond.

Transcript

Jack Kopanski: How do you anticipate this upcoming election and other ongoing global events to affect construction the rest of the year? What are you seeing as far as current supply chain or lead time impacts? And you know, how is an administration change come November – and I guess effectively, January – going to affect the industry next year?

Richard Branch: Listen, I think obviously our attention and the world’s attention is on the election, right? But when you look at the data, this is what we cling to, right? When you look at the data, and we’ve done this analysis going back to federal elections starting in 1967, it’s just not a needle mover. It isn’t. In the building market, especially. If you think about it, all candidates, all presidential candidates have platforms that they espouse, right? But we need to remember Congress needs to approve it. So it’s not just about the president, it’s about what that makeup of Congress is as well.

So, in terms of what could move the needle from an election standpoint, when it comes to resi and non resi buildings, it’s really state and local, right? It’s state and local elections that are approving bond measures, tax incentives, zoning changes that all incentivize construction. So, if we want to pay attention to elections and how they impact you really got to go local, local, local. The one difference to that would be federal spending on infrastructure, right? That is president, and that is Congress that dictates that. Good news there, we were just chatting about it, those IIJA funds are in the system. The infrastructure law was broadly bipartisan, or at least relative to today’s standards of what bipartisan means, and I don’t think there’s really any real risk of those funds being repealed or changed at all, even if the administration and Congress … I think those laws, I think those those monies, are pretty safe.

So long story short, I just don’t think the federal election’s a real needle mover. It is psychologically, I think. And maybe people were sitting and waiting, but they’re probably waiting more to see what the Fed is going to do and say, rather than what’s going to happen in early November with the election.

In terms of geopolitical, I guess when I look at the world, right, that geopolitical risk is certainly enhanced, and certainly what worries us is the Middle East. And if that conflict were to become larger and more countries become involved in that, would we see a run up in oil prices? And if oil prices were higher consistently, that could certainly harm consumer spending, potentially pushing the US economy into recession. I guess the other side of that is it would probably push the Fed into moving a lot sooner rather than later, a lot more aggressively in interest rates.

Related: AGC economist discusses 2024 election impacts

Featured Photo: P&Q Staff

Van der Graaf is the leader in the design and manufacturing of drum motors for belt conveyors, with a strong focus on reliability and longevity. The GrizzlyDrive Drum Motor provides a robust, maintenance-free belt drive solution for mining and aggregate conveyors. Learn More.