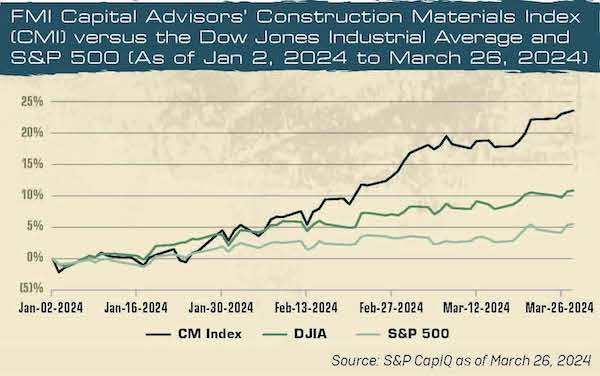

As the first quarter comes to a close, share prices for construction materials companies continue to outperform the broader markets.

Factors such as pricing momentum, IIJA projects coming online and broad economic optimism have given investors confidence in construction materials index (CMI) company stocks. These tailwinds have also spurred recent mergers and acquisition activity for the sector, headlined by Martin Marietta’s $2.05 billion acquisition of Blue Water Industries’ Southeast aggregate assets.

There is room to grow for these companies, especially if inflation continues to trend downward and the Fed begins to cut interest rates. Favorable monetary policy could propel construction materials stocks even higher.

The CMI combines the stock performance of 16 publicly traded companies that operate primarily in the hot-mix asphalt, ready-mixed concrete and construction aggregate space within the U.S.