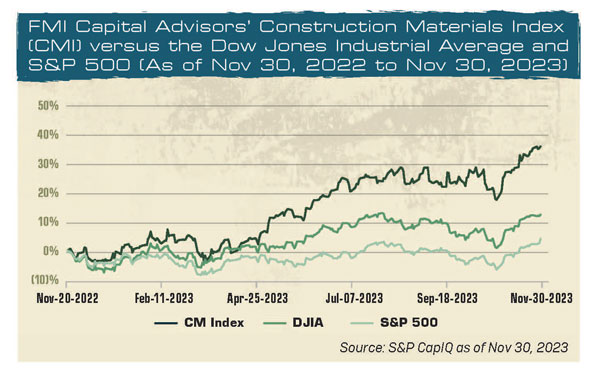

Heading into the final weeks of 2023, we see the market performance for construction materials firms continue to shine, outpacing the general indices by a significant margin.

FMI’s Construction Materials Index (CMI) has been rewarded throughout the year due to optimism in the sector. Investors are bullish about the strong funding and effective price increases, despite aggregate volumes being down compared to last year.

Most CMI companies are reporting increased bottom line performance, with EBITDA margins (a proxy for cash flow) outpacing 2022 results. This strong financial performance has allowed for several major acquisitions to take place in recent months, including: Vulcan Materails’ sale of its Texas ready-mixed concrete assets to SRM, and Martin Marietta’s sale of its cement operations to Unacem in California and CRH in Texas.

Be on the lookout for FMI’s 2023 full-year review for construction materials, which will be included with the February 2024 edition of Pit & Quarry.

The CMI combines the stock performance of 18 publicly traded companies that operate primarily in the hot-mix asphalt, ready-mixed concrete and construction aggregates space within the United States.

Related: How producers are performing at the end of the third quarter

Featured photo: P&Q Staff