So much to watch, so much to see.

The next 11 months will be fascinating to follow. At Pit & Quarry, we’ll be keeping an eye on a variety of trends in aggregates during that span. Here are six we’ll be watching closely as ConExpo-Con/Agg nears and another production season gets underway.

1. Autonomy. Will autonomy move from concept to commercialization?

Maybe we aren’t there industrywide just yet, but Caterpillar, which has been a leader on the autonomy front, indicated at CES 2026 last month that the technology will be extended to more than just haul trucks.

Excavators, loaders and dozers will ultimately be outfitted with autonomy, raising the question of just when rolling stock will be unmanned in pits and quarries.

2. Connectivity and the digital jobsite. Will this become the industry standard in 2026?

Equipment manufacturers have been touting the idea of the connected jobsite for some time now. But will more producers buy in at this stage and transition their operations accordingly? That’s what I’m eager to watch.

3. Merger and acquisition activity. Which producers will be active buyers, and what will their motivations be?

As of press time, we haven’t seen any 2026 megadeals take place in aggregates. But one or two are bound to happen this year, as the market environment remains conducive to dealmaking. Expect to see additional platform deals transpire in 2026, and bolt-on activity should once again be aplenty.

4. Safety and MSHA. What will ultimately drive fewer incidents?

Industry fatalities were unfortunately up 27 percent in 2025, with 33 miners killed in mining accidents (see page 84 for more). Will the Mine Safety and Health Administration (MSHA) respond with any enforcement? And what’s next for the crystalline silica rule? Both bear watching.

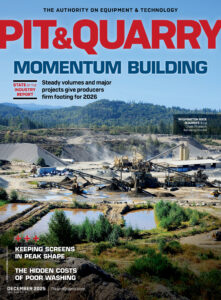

5. Aggregate volumes and pricing. Will the momentum here continue?

No one’s necessarily been moaning about how volumes have trended of late, but they nonetheless trended down until the second half of 2025.

Steady increases on the pricing front, along with stricter cost management, drove producer profitability over the last couple of years. Will we see more of the same on volumes and pricing in 2026, or will one or both take a different trajectory?

6. Construction markets. Which sectors will drive demand, and can residential rebound?

Federal infrastructure funding by way of the Infrastructure Investment and Jobs Act (IIJA) gave the industry a strong leg to stand on over the last few years. The five-year IIJA, however, expires at the end of September.

Is there appetite in Congress for another multiyear bill? And will residential finally get over the hump and become a viable supporting market?

Managing editor Jack Kopanski and I discuss these six trends at length – as well as four others – on Episode 58 of P&Q’s Drilling Deeper podcast. Listen today at drillingdeeperpodcast.com, or wherever you get your podcasts.

Related: What’s next for aggregates?