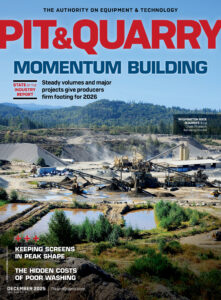

“Our backlog is strong – phenomenal through Q1. There’s a lot of quoting activity, a lot of projects in the pipeline and plenty of decisions waiting to be made by producers. If even a fraction of those quotes convert into real sales, we’re set up for a great year.”

Mike Krajewski, Masaba

“First, demand trends across our key end markets remain broadly constructive. Infrastructure activity continues to be strong, supported by record levels of federal and state investment. Second, nonresidential construction is benefiting from accelerating data center development, a recovering warehouse sector and early signs of renewed momentum in domestic manufacturing. Third, light nonresidential demand, while typically more interest rate-sensitive, has demonstrated notable resilience. While near-term residential demand remains subdued, moderating mortgage rates suggest a gradual path toward normalization.”

Ward Nye, Martin Marietta

“We are focused on finishing 2025 strong, and we expect the work we are doing to manage costs, optimize prices and grow our business to pay off in 2026 and beyond. We have record backlog and a skilled team that is eager to continue implementing our strategies and delivering for our shareholders.”

Brian Gray, Knife River Corp.

“2025 has been a great year. We’ve partnered with companies like Masaba and expanded into other product lines. We’ve doubled our sales force. We’ve grown the business by more than 30 percent over the last two years. It’s been an amazing stretch for us, though I wouldn’t say that necessarily reflects the entire industry. The Midwest market has always been strong, and I don’t see that changing.”

Bob Meyers, U.S. Equipment Sales & Rentals

“Producers are gearing up for more volume next year. Many of my customers are already investing in newer, better equipment ahead of 2026. I don’t see things slowing down anytime soon.”

Jared Riley, ICM Solutions

“As we look to 2026, I’m encouraged about the demand backdrop in our markets. We expect continued strength in public construction activity and an improving private nonresidential outlook, a combination that should also benefit an already healthy pricing environment.”

Tom Hill, Vulcan Materials Co.

“Our outlook for the remainder of the year remains very positive. Overall demand trends are favorable, and we believe our U.S.-focused operations are well-aligned with long-term infrastructure and secular power market drivers.”

Antonio Carrillo, Arcosa

“Training has become a major priority for producers. They’re investing the time to educate their people and get things right the first time.”

Aaron Gibbs, ASGCO

“There’s still uncertainty out there. Housing and residential construction have been spotty, if not down overall. But in the areas where we operate, infrastructure investment remains strong. We’re cautiously optimistic – like most people right now – and as we budget for 2026, the sales outlook still looks solid. We’re excited to attack it.”

Chris Williams, Capital Aggregates

“Looking ahead, we anticipate a more mixed demand picture, with ongoing data center construction demand being partially offset by softer demand from some of the other industries that we serve.”

Timothy Byrne, USLM

Related: Perspectives: Industry voices on growth and what’s next